- Sustainable Data Center's Newsletter

- Posts

- 5 Reasons Nordics Data Centers mirrors early opportunity of Amazon’s IPO

5 Reasons Nordics Data Centers mirrors early opportunity of Amazon’s IPO

5 Reasons Why Impact Invest in Nordics Data Centers today mirrors early opportunity of Amazon’s IPO

For Family Offices, Investors, SME cashflow positive. Build your own Infrastructure, Escape scenarios beyond your control for wealth preservation and legacy. Impact invest in Sustainable Bitcoin Mining Farms & AI Data Centers against inflation and geopolitical turmoil.

What’s inside the 5-Step Guide and Case Study?

Step 1: Discover how global demand for AI-ready infrastructure is creating a lucrative super cycle.

Step 2: Learn about the unparalleled efficiency and scalability of hydropower-driven data centers.

Step 3: Explore compounding value through both physical (real estate) and digital assets (Bitcoin).

Step 4: See how this opportunity mirrors early investments in groundbreaking companies like Amazon.

Step 5: Understand the tangible long-term returns estimated to grow by over 6,800% within 3-5 years.

#1 Nordics as a Prime Data Center Location

Cold climate reduces need for cooling operations

Proximity to abundant, sustainable hydropower (90% efficiency). Reduced energy transmission losses due to proximity to data centers

Hyperscalers (Google, Meta, Amazon) investing heavily in the region

Concrete data center real estate value up to 750k per Megawatt (MW)

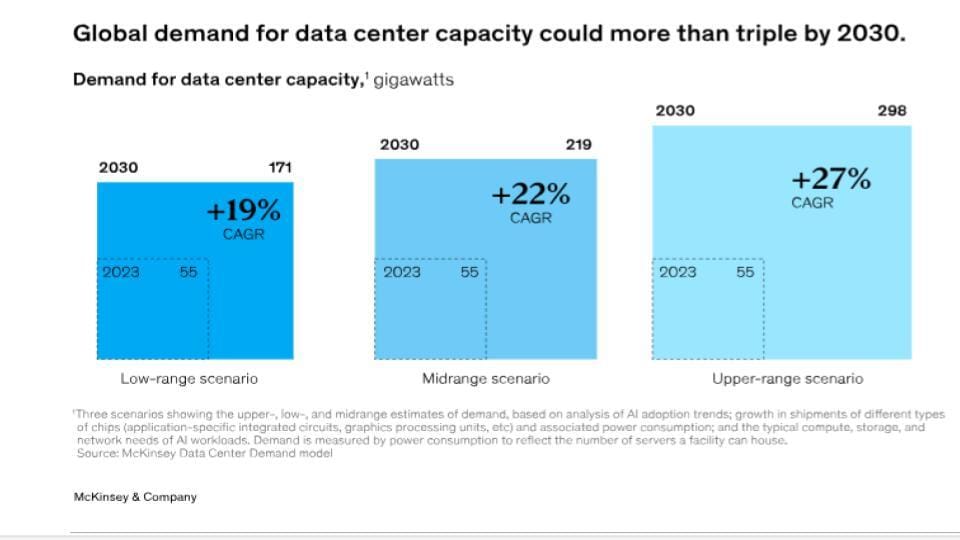

A Growing Market: global data center demand could more than triple by 2030

Investing in Data center super cycle: surging needs for cloud services, IoT, massively for AI-ready infrastructure

Green energy cheaper and carbon negative

Cash Flows from passive income

#2 Hydropower is the most efficient energy source for powering data centers?

Source Home - Eurostat

efficiency of up to 90%, far surpassing other renewable sources like solar (15-20%) and wind (30-45%)

constant and predictable energy output suits 24/7 power demands

scalability for large power demands generate large amounts

proximity to data centers in remote locations

pumped storage systems, which act as giant batteries, storing excess energy during low demand and releasing it during peak usage

#3 BlackRock bitcoin mining acquisition strategy

Secure a steady stream of newly minted bitcoins at a lower cost than buying them directly from exchanges

Gain exposure to Bitcoin while mitigating some of the risks associated with price volatility

The cost of mining remains relatively stable over the long term allowing it to accumulate bitcoins at a predictable cost

Highly liquid newly minted bitcoin reach market price up to 50% premium

#4 What Happens when holding bitcoin in a company treasury?

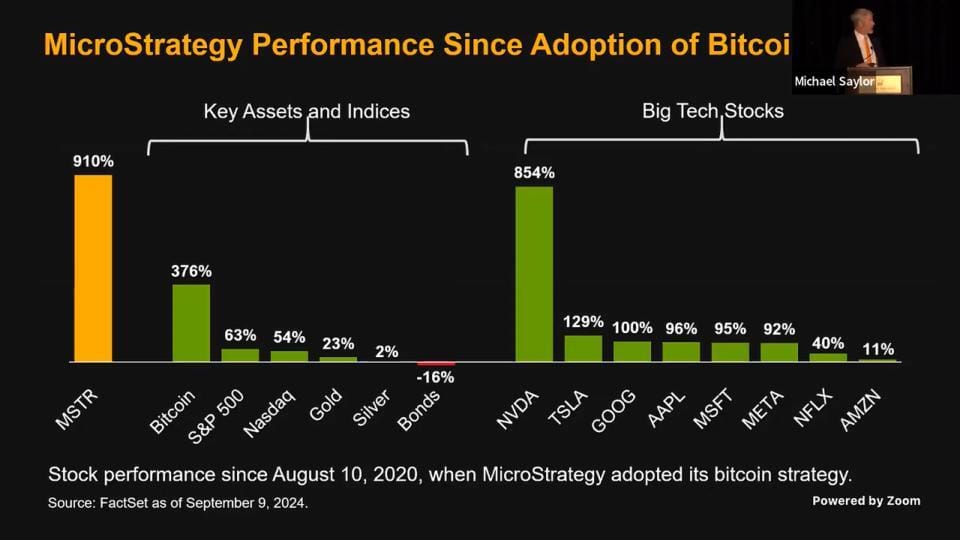

Source: Michael J. Saylor

MicroStrategy.com, Michael Saylor's public company, is the best performing asset compare the main big tech stocks including Invidia

since August 2020 Its the result of compounding bitcoin in the balance sheet plus MicroStrategy corporate value

#5 Example 100k investment, compounding the corporate value plus physical and digital assets

Investing in Data Centers shares pre IPO you can appreciate:

mitigate the risk of investing in a startup and acquire shares discounted pre IPO

combining physical and digital assets in the balance sheet

the value of a concrete data center real estate up to 750k per Megawatt (MW) long term investment 3-5 years estimated combined value 6801%

Conclusion

Summing up the value family offices can derive from the provided guide:

High Growth Potential: Investing in sustainable Nordics data centers mirrors the early growth trajectory of Amazon's IPO, with opportunities for significant compounding returns through real estate appreciation and corporate value growth.

Sustainable and Efficient Energy Use: Leverages abundant, efficient hydropower (90% efficiency) in the Nordics, reducing operational costs and supporting environmentally conscious investment goals.

Market Demand and Stability: Capitalizes on the growing demand for AI-ready, cloud-based infrastructure, with passive income potential and scalability for long-term investment.

Innovative Digital Asset Integration: Incorporates Bitcoin mining and holdings into investment strategies, offering exposure to digital assets while mitigating volatility risks.

Diversified and Tangible Asset Base: Combines physical assets like real estate with digital assets, providing a balanced portfolio approach with reduced startup risks and high long-term value with shares at discount price pre IPO

Amazon stock has gained a 250,300% from the IPO in the 97'. Investing 10K in 97'would worth approximately €26,999,999.69 euros today. Sustainable Data Centers in the Nordics is like investing in Amazon stocks in 97' due to the compounding value of Nordics Data Center growth equity investment - the Amazon effect!

Receive a due diligence advisory after scheduling a call to discuss blockchain and AI sustainable data centers opportunities that suite your strategy!

Reply